Peer to Peer lending (p2p) is a platform for lenders to access funding outside banking institutions. List of Peer to Peer Lending Platforms in Kenya. Before the advent of technology, this happened a lot within Chama’s and Merry-go-rounds. However, with technology adoption in Kenya, online platforms have been established that connect lenders to borrowers. Investors in platforms are everyday people who have extra cash in their hands and are willing to lend it to others and earn some interest in the process.

Advantages and Disadvantages of Peer To Peer Lending in Kenya

Like anything else, peer to peer lending has got its advantages as well as its downside to the individuals involved.

Advantages of Peer To Peer Apps

The advantages involved with crowd funding are that the process of getting a loan or giving the loan is easy, low interest loans as well as high returns for investors. Borrowers and investors are able to have all transaction reports.

- Everything is done online, and it’s fast.

- You do not have to give security for a loan, as most loans are unsecured.

- Lower or sometimes no interest charges.

- Automatic repayments

- Funds can be used for another reason other than the one borrowed without any need for approval as long as repayments are made.

Disadvantages of Peer To Peer Apps

Crowd funding has got a very high risk for borrowers to default on the loans and also there is no insurance or Government protection in case of any losses.

List of Peer to Peer Lending Platforms in Kenya

Zidisha

Zidisha allows people to lend small amounts of money directly to entrepreneurs in developing countries. It is the first peer-to-peer microlending service to link borrowers and lenders across international borders without a local microfinance institution intermediary.

Kiva

Kiva is a 501 non-profit organization headquartered in San Francisco, California, that claims to allow people to lend money via the Internet to low-income entrepreneurs and students in 77 countries. Kiva’s mission is “to expand financial access to help underserved communities thrive.”

Uba Pesa App

UbaPesa is the best peer to peer lending app in kenya which allows you to lend and borrow money in real time! · Discover what all the buzz is about!· The app automatically matches a borrower to a lender based on the amount, loan period and credit score rating. A lender can also choose a borrower manually regardless of the credit score, the number of days, and the amount.

WayHoty App

Wayhoty Capital is a fintech technology company that specializes in offering various loan products and services.

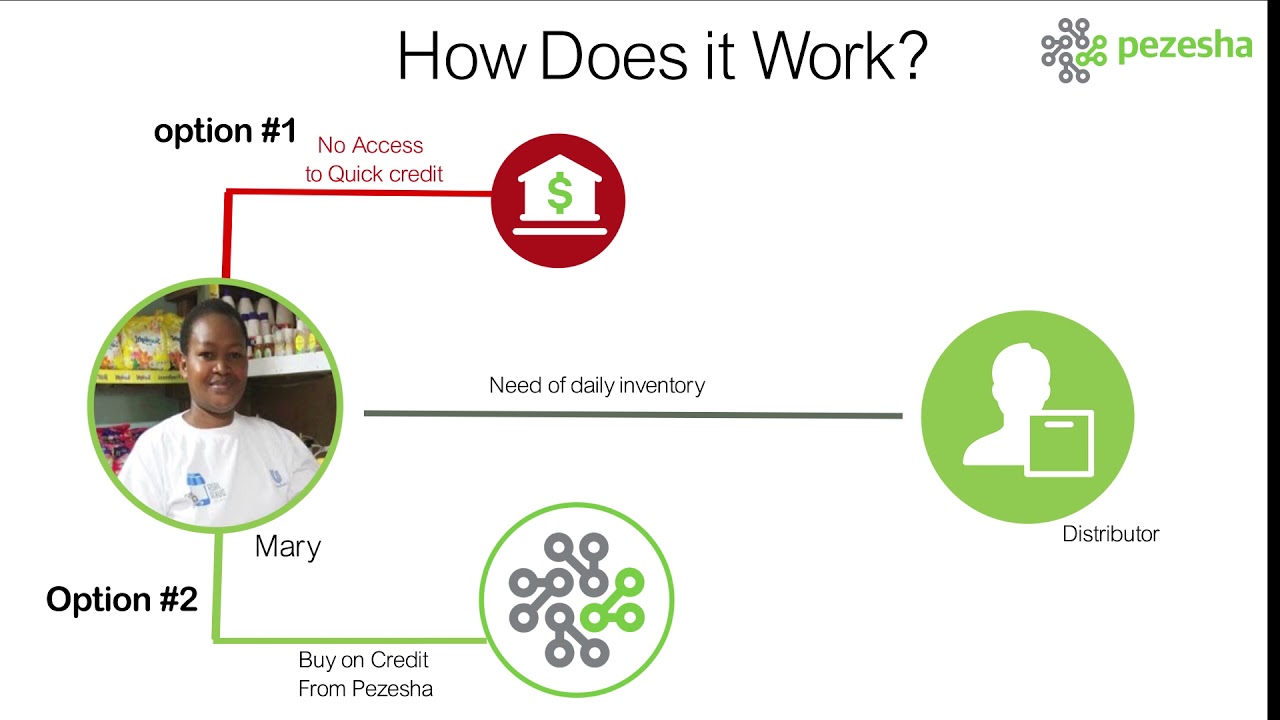

Pezesha

Pezesha has 6 investors including Black Founders Fund And Venture Garden Group. Pezesha is located in Nairobi, Nairobi Area, Kenya. We started in late 2016. Our headquarters are in Kenya. Pezesha has created a holistic digital financial infrastructure that is on a mission to the leading enabler platform and marketplace that connects small and medium sized businesses to working capital through a collaborative approach where banks, MFIs and other financial institutions or networks can connect on our platform to be matched with quality SMEs driving meaningful financial inclusion and reducing any inequalities on access to formal financial services. Read more about the genesis of Pezesha in an interview by our CEO with Fintech times here

Pesapata app

PesaPata is a peer-to-peer lending platform which allows shrewd lenders to interact with creditworthy personal loan borrowers, so both receive a much better deal. Peer to Peer lending (P2P) offers both borrowers and lenders significant efficiencies over the traditional banking model.

Loan254

Loan254 is a Kenyan based peer to peer lending platform. Loan254 app is a product of Wayhoty Capital a registered financial fintech services company in Kenya.

Hela Pesa (Hela P2P)

Borrowers and Investors can transact through the Hela P2P online platform through the virtual financial market where borrowers get loans and investors get returns on their loan lending.