Kenya has long been celebrated as a hub of entrepreneurship in Africa, with many business magnates building multi-billion-shilling empires from scratch. These entrepreneurs not only showcased exceptional business skills but also contributed significantly to the country’s economic progress. However, some of these once-thriving enterprises eventually collapsed due to factors such as mismanagement, lack of succession planning, and financial strain. Here’s a look at some prominent Kenyan tycoons whose businesses failed and the key lessons drawn from their experiences.

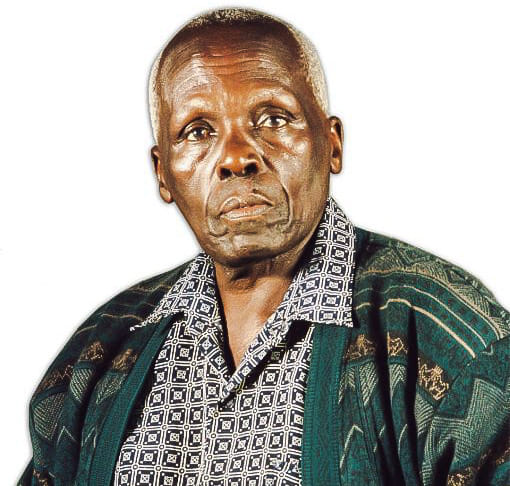

1. Njenga Karume: A Legacy That Withered

Njenga Karume, a former cabinet minister and entrepreneur, rose from modest beginnings as a charcoal trader to establish a vast business empire spanning real estate, hospitality, and significant investments in major companies. At its peak, his estate was valued at over Ksh 40 billion.

Following his death in 2012, the fragility of his empire became evident. Poor succession planning, family disputes, and alleged mismanagement led to the rapid decline of his businesses. Despite the establishment of the Njenga Karume Trust to manage his estate, several enterprises either collapsed or lost substantial value. His story underscores the critical need for structured continuity plans in family businesses.

2. Joram Kamau: Tuskys’ Journey from Success to Bankruptcy

Joram Kamau founded Tuskys, once one of Kenya’s leading supermarket chains, employing over 6,000 people. Under his leadership, the chain grew into a household name. However, after Kamau’s death, a lack of clear succession plans and escalating family disputes spelled disaster.

By 2020, Tuskys was drowning in debts exceeding Ksh 6 billion, compounded by financial mismanagement, fraud allegations, and fierce competition from other retailers. The closure of its stores marked the end of a once-dominant player in Kenya’s retail market.

3. Atul Shah: The Rise and Fall of Nakumatt

Atul Shah transformed Nakumatt into one of East Africa’s most prominent retail brands, with over 60 outlets across the region. Valued at over Ksh 65 billion at its peak, Nakumatt’s dominance began to crumble in 2016 due to poor financial management and overambitious expansion.

With debts exceeding Ksh 30 billion, coupled with supplier boycotts and declining customer trust, Nakumatt eventually shut its doors. The business was liquidated by 2020, signaling the end of an era. Nakumatt’s downfall highlights the dangers of overexpansion and neglecting fiscal discipline.

4. Sherali Hassanal: The Demise of Alibhai Panju Construction

Sherali Hassanal’s Alibhai Panju Construction was a leading player in East Africa’s infrastructure development, employing thousands and completing landmark projects. However, after Hassanal’s death, family disputes and financial mismanagement took their toll.

Despite efforts to restructure leadership and salvage the business, Alibhai Panju could not withstand mounting debts and fierce competition. Its collapse left many unemployed, spotlighting the challenges family-owned businesses face during leadership transitions.

5. Spencer Ndegwa: The Fall of Spencon

Spencer Ndegwa’s Spencon was a construction powerhouse, operating in Kenya, Tanzania, Uganda, and beyond, with a workforce exceeding 5,000 at its height. The company played a critical role in regional infrastructure development.

Financial challenges emerged following a $5 billion investment from Emerging Capital Partners (ECP). Mismanagement, rising debts, and market shifts led to its decline. Despite attempts at restructuring and securing funding, Spencon ceased operations in 2020, marking the end of another East African giant.

Key Takeaways from the Collapses

The stories of these business moguls offer valuable lessons for entrepreneurs:

- Succession Planning: Clear leadership transition plans are essential for family-owned businesses to ensure continuity.

- Financial Discipline: Maintaining strong financial management, including prudent debt control and liquidity, is critical for sustainability.

- Adaptability: Businesses must stay agile and responsive to evolving market conditions.

- Governance and Leadership: Robust governance structures can mitigate risks tied to mismanagement and internal disputes.

- Customer Trust: Building and retaining customer loyalty is vital, particularly in competitive industries like retail and construction.

Conclusion

The collapse of these multi-billion businesses serves as a poignant reminder of the unpredictable nature of the corporate world. While their founders left a significant legacy on Kenya’s economy, their downfalls underscore the necessity of strategic planning, strong governance, and adaptability. As Kenya continues to nurture its entrepreneurial spirit, these lessons remain invaluable for future business leaders.