In Kenya, the Kenya Revenue Authority (KRA) mandates all individuals with an active Personal Identification Number (PIN) to file annual tax returns, even if they have not earned any income. Filing a nil return informs KRA that you have no taxable income for the year.

Failure to file returns, including nil returns, may result in penalties and hinder access to government services. Whether you’ve been unemployed or your income was nonexistent, filing nil returns is essential for compliance.

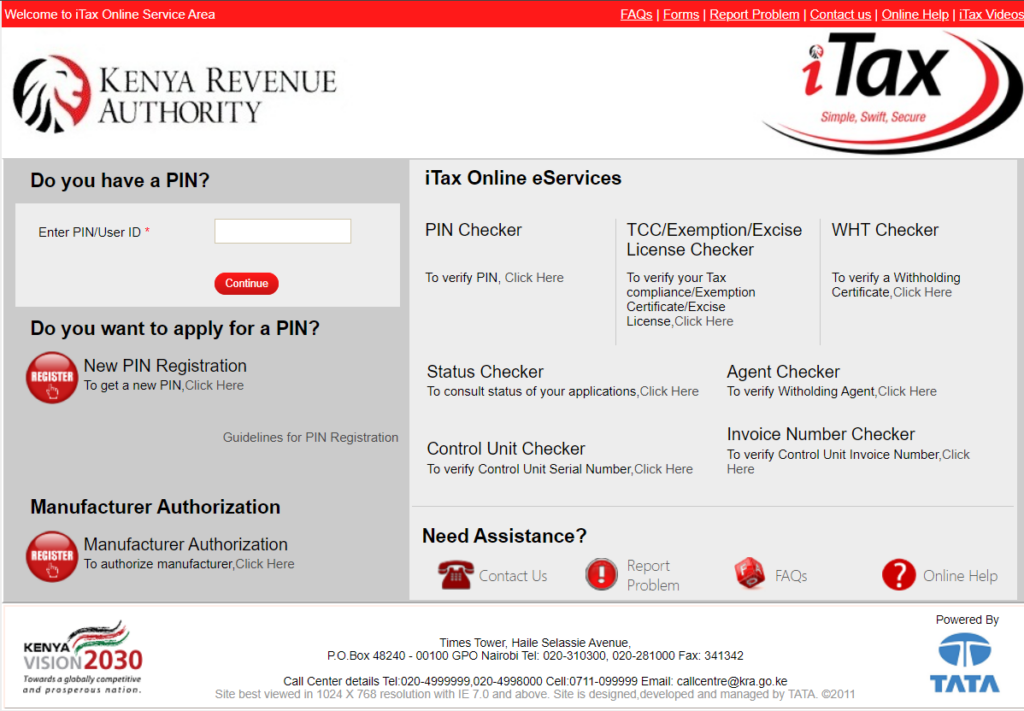

This guide provides a comprehensive, step-by-step process to help you file nil returns using the iTax platform.

What You’ll Need Before Filing Nil Returns

Ensure you have the following items ready before starting the process:

- Active PIN: A valid KRA PIN is required to access the iTax platform.

- If you don’t have one, register for a PIN online at the KRA website.

- Tax Year: Nil returns are filed for the previous year (January 1–December 31).

- Internet Access: A computer or smartphone with a stable internet connection.

- Tax Obligations: Nil returns are applicable only if you have no taxable income for the previous year.

How to File Nil Returns on iTax: Step-by-Step Guide

Step 1: Log in to the iTax Portal

- Visit the iTax platform at https://itax.kra.go.ke.

- Enter your KRA PIN and password.

- If you’ve forgotten your password, click “Forgot Password” and follow the prompts to reset it.

- Log in using your PIN and new password.

Step 2: Navigate to the “Returns” Section

- Once logged in, locate the “Returns” menu in the main dashboard.

- Click on the “Returns” option to access the tax filing functions.

Step 3: Select “File Nil Returns”

- Under the “Returns” section, choose “File Nil Return.”

- This will direct you to a new page where you’ll select the tax obligation for the nil return.

Step 4: Choose Your Tax Obligation

- On the “File Nil Returns” page, select the applicable tax residency obligation from the dropdown menu:

- Income Tax Resident: For Kenyan residents.

- Income Tax Non-Resident: For non-residents.

- Click “Next” to proceed.

Step 5: Confirm Tax Dates

- Verify that the tax year displayed is correct (usually the previous calendar year).

- Click “Submit.” A confirmation pop-up will appear. Click “OK” to finalize the submission.

Step 6: Download the Acknowledgment Receipt

- After submitting, you’ll be redirected to a confirmation page.

- Click “Download Returns Receipt” to save a copy of the acknowledgment.

- This document serves as proof of filing and may be required for future reference.

Additional Tips for Filing Nil Returns

- File on Time: File nil returns by June 30th of the following year to avoid penalties.

- Contact Support for Assistance: If you encounter challenges, contact KRA via:

- Email: [email protected]

- Phone: +254 20 4 999 999 or +254 711 099 999

- Visit your nearest KRA office.

- Track Tax Obligations: Stay updated on your tax status to ensure compliance.

- Consult a Tax Professional: Seek expert advice if you’re uncertain about your obligations.

Key Reminders

- Who Should File Nil Returns?

- Nil returns are for individuals with no taxable income for the year.

- What If I Earned Income?

- If you earned income, even below the taxable threshold, you must file regular tax returns.

- Penalties for Late Filing

- Failure to file returns can attract penalties of Ksh 2,000 or more.

Final Remarks

Filing nil returns is straightforward and ensures compliance with tax regulations. By following this 6-step guide, you can quickly file your nil returns using the iTax platform and avoid penalties. Stay compliant and file your nil returns annually, even if you have no income to declare.

Happy filing!